In an insightful interview, Mr. Felix Engelhardt, Country Manager at Rödl & Partner Malaysia, provides a closer look at how the firm’s integrated service approach, rooted in German standards and local knowledge, supports international businesses, especially Italian companies, in navigating Malaysia’s dynamic market.

With a deep dive into the legal, regulatory, and economic landscape, Mr. Engelhardt discusses Malaysia’s business climate, key challenges, and Rödl & Partner’s commitment to ethical, client-focused values.

Mr Felix Engelhardt, Country Manager at Rödl & Partner Malaysia

1. Could you provide a comprehensive overview of Rödl & Partner’s operations and services in Kuala Lumpur? How does your firm uniquely position itself in the market?

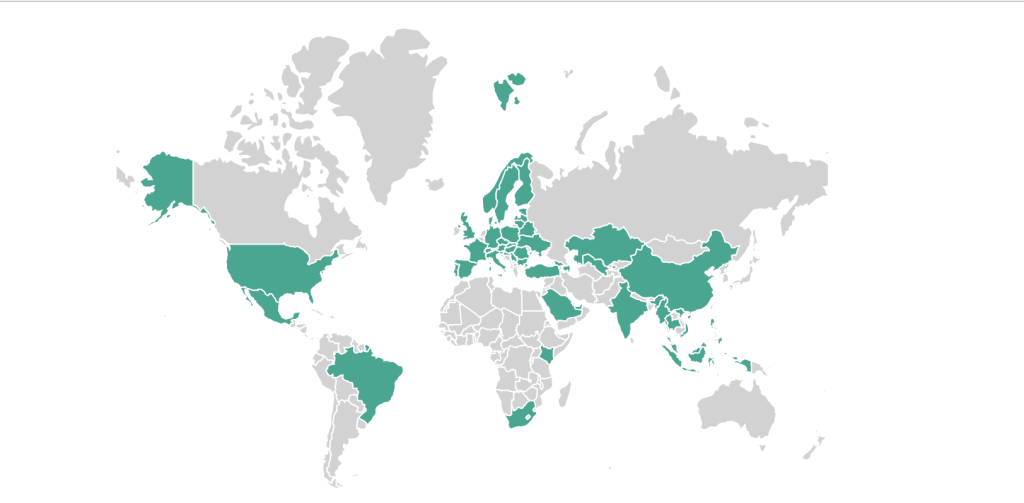

Rödl & Partner is an integrated professional services firm with 111 wholly owned offices in 50 countries globally. Established in 1977 in Nuremberg, Germany, the firm has experienced significant and continuous growth by setting up its own offices. This approach fosters interlinked, multi-disciplinary, and cross-border collaboration among colleagues, rather than relying on a franchise network.

With over 200 experienced local and European professionals, Rödl & Partner has been in the Asia Pacific region since 1994. The firm offers a full range of services, including compliance, international tax planning, optimization of regional holding structures, corporate and legal services, audit, accounting, payroll, and outsourcing services. Rödl & Partner combines international know-how and standards with local experience and expertise.

Our globally active experts work closely together to achieve the highest standards, ensuring that clients benefit from their experience regardless of where their projects occur. Rödl & Partner is not just a collection of accountants, auditors, lawyers, management, and tax consultants working in parallel; we work together, closely interlinked across borders and service lines.

2. What is your assessment of the current economic climate in Malaysia? Could you elaborate on the key aspects of the legal/regulatory, tax and financial frameworks that impact foreign businesses?

Malaysia’s economy is showing resilience and growth, with GDP projected to grow by 3.9% in 2024 and 4.8% in 2025. The economy is driven by robust domestic demand and a recovery in exports, supported by improvements in the labour market, lower inflation, and government cash transfers. Key sectors such as electronics, electrical products, AI, and 5G technology are expected to see significant growth.

Legal and Regulatory Framework

Malaysia’s legal and regulatory framework is comprehensive and well-structured, providing a stable environment for businesses. Key aspects include:

- Corporate Governance: The Companies Act 2016 governs corporate activities, ensuring transparency and accountability. Recent amendments, such as the Companies (Amendment) Act 2024, enhance corporate governance and introduce new provisions for the disclosure of beneficial ownership.

- Intellectual Property: Malaysia has robust intellectual property laws, including the Patents Act 1983, the Copyright Act 1987, and the Trademarks Act 2019, which protect the rights of inventors, authors, and brand owners.

- Employment Law: The Employment Act of 1955 regulates employment relationships, ensuring fair treatment of employees. Recent updates have focused on improving workers’ rights and benefits.

- Environmental Law: Malaysia has stringent environmental regulations, including the Environmental Quality Act 1974, which governs pollution control and environmental protection.

- Digital Economy: Malaysia is updating its legal framework to support the digital economy, including regulations for data protection, cybersecurity, and digital transactions. The Personal Data Protection Act 2010 and the upcoming amendments aim to enhance data privacy and security.

These developments reflect Malaysia’s commitment to creating a conducive environment for business growth and sustainability.

The legal framework is continuously evolving to address new challenges and opportunities, ensuring that Malaysia remains an attractive destination for foreign investments.

Tax Framework

Malaysia’s tax framework includes several aspects that impact foreign businesses:

- Corporate Tax: The corporate tax rate is 24%, with various incentives available for specific sectors and activities.

- Dividend Tax: A new 2% tax on local dividend income exceeding RM100,000 for individual shareholders has been introduced.

- Tax Incentives: There are targeted incentives for high-value activities, including Integrated Circuit (IC) Design services and investments in smart logistics complexes.

- Foreign-Sourced Income: The tax exemption on foreign-sourced income received by individuals in Malaysia has been extended for another 10 years.

Financial Framework

The financial framework in Malaysia supports business growth through various initiatives:

- Investment Incentives: The government offers incentives for investments in technology, green energy, and infrastructure projects.

- Subsidy Rationalization: Subsidies are being rationalized to target lower-income groups, which may impact business costs.

- Fiscal Policies: The government is committed to fiscal responsibility, aiming to reduce the fiscal deficit to 3.8% of GDP by 2025.

Key Elements of Budget 2025

The recently announced Budget 2025 focuses on three main pillars: Reinvigorating the Economy, Driving Reforms, and Prospering the Rakyat. Key highlights include:

- Economic Growth: The budget allocates RM421 billion to stimulate economic growth through infrastructure development, innovation, and digitalization.

- Tax Reforms: Introduction of a 2% dividend tax on incomes over RM100,000, expansion of the Sales and Service Tax (SST) to cover more services, and targeted tax reliefs for medical treatments, mental health, and elderly care.

- Subsidy Reforms: Rationalization of petrol and diesel subsidies to focus on lower-income groups.

- Social Welfare: Increased minimum wage from RM1,500 to RM1,700, and expanded tax reliefs for education, medical insurance, and disabled children.

- Green Initiatives: Incentives for businesses investing in green technologies and automation.

Overall, Malaysia’s economic climate is favourable for foreign businesses, with supportive tax, regulatory, and financial frameworks. The Budget 2025 aims to enhance the business environment further and promote sustainable growth.

Instead of relying on networks or franchise systems, Rödl & Partner emphasizes close interdisciplinary and cross-border collaboration with its in-house colleagues. With a strong global presence, Rödl & Partner delivers international expertise through a comprehensive, one-stop-shop approach.

3. What specific services does Rödl & Partner provide to companies looking to enter or expand in the Malaysian market? Additionally, how have you tailored your services to meet the needs of Italian companies?

Rödl & Partner supports companies at every stage of their business expansion plans and operations in Malaysia. From preliminary feasibility studies to market entry preparations to initial setup as well as with ongoing tax, legal*, accounting, payroll and regulatory compliance and advisory, Rödl & Partner is your one-stop shop in Malaysia.

*In Malaysia, legal services are provided by the Malaysia Bar Council licensed law firm Geetha Salva & Associates in association with Rödl & Partner.

Additionally, with close knowledge of the specific circumstances of the Italian and EU markets, we are on hand with interdisciplinary and cross-border advice for Italian enterprises planning to invest and do business in Malaysia.

Our multilingual Italian, German and Malaysian colleagues in Rödl & Partner offices in Bolzano, Milan, Padua, Rome and Kuala Lumpur provide end-to-end professional services in all audit, legal, tax and accounting-related matters.

The team behind Rödl & Partner Malaysia

4. From your experience, what are the primary challenges that foreign companies face when operating in Malaysia, and how can they effectively navigate these obstacles?

Shortage in High-Skilled Workforce

There is a mismatch between the skills required by industries and those possessed by the workforce. This is particularly evident in sectors like technology, engineering, and healthcare. In addition, an ageing population means fewer experienced professionals in the coming years. Many skilled professionals also seek opportunities abroad, leading to a loss of talent within the country.

Mitigation strategies involve partnering with universities and vocational schools to align curricula with industry needs and offer internships and apprenticeships. Invest in continuous learning programs to upskill and reskill existing employees. Create a conducive work environment with competitive salaries, benefits, and career development opportunities, and utilize automation and AI to increase productivity and reduce dependency on high-skilled labour.

Immigration Matters for Expatriates

Navigating the immigration process can be complex and time-consuming, and meeting the eligibility criteria for various passes and permits can be challenging. We recommend working with immigration consultants to streamline the application process and ensure compliance with all requirements. Furthermore, it is important to ensure all necessary documents, such as employment contracts, proof of qualifications, and company registration details, are in order and submitted to the competent authority promptly.

Business Licenses

Different types of businesses require different licenses, which can be confusing. Obtaining licenses can be time-consuming, especially for foreign-owned companies. Work with local business consultants who are familiar with the licensing process and can expedite applications. Ensure all required documents are complete and accurate to avoid delays.

Bank Account Opening

Banks have rigorous Know Your Customer (KYC) requirements, making it difficult for foreign companies to open accounts. Most banks require in-person verification, which can be inconvenient for non-residents. Gather all required documents, such as a resolution from the board of directors, list of directors, certificate of incorporation, memorandum and articles of association, registered office address etc. Some banks may have more flexible requirements for foreign companies. Research and select banks that are known to be more accommodating.

5. Could you share insights into your business ethics and the core values that guide Rödl & Partner’s operations? How do these principles influence your relationships with clients?

Rödl & Partner is the agile caring partner for “Mittelstand” shaped world market leaders. Just as with most of our clients, an entrepreneurial heart beats within us. We have the same pulse rate. This leads us to have the same convictions. So we all agree: it‘s not enough just to decide that one would like to act in an entrepreneurial manner. This alone is not enough to create the pioneering entrepreneur. In addition, relentless drive is necessary, a kind of restlessness similar to that of a watch movement. This enables bustling activity, industriousness, inspiration, enthusiasm and a healthy attitude to risk-taking.

The core brand values of Rödl & Partner

The “one firm” concept is at the centre of the brand identity of Rödl & Partner. All services are offered under the brand name “Rödl & Partner”. To strengthen the brand sustainably and to ensure recognition in external as well as internal communication, worldwide uniformity is necessary.

Our brand, however, does not only consist of a logo but also defines our unique selling propositions and our business model through our brand DNA.

6. What distinct competitive advantages does Rödl & Partner offer compared to other consulting firms in Malaysia, particularly for companies from Italy?

As outlined above, Rödl & Partner’s unique value proposition lies in our integrated, multi-disciplinary service structure, our global presence in around 50 countries and our ability to assist our clients from one single source instead of through a network of franchise and cooperation partners.

Our legal, tax, finance IT and management consulting professionals work closely together which enables us to handle projects holistically instead of adopting a narrow, one-sided perspective. Our clients seek our support because of both our knowledge and capabilities in the respective market as well as our strengths in international, cross-border business scenarios. We ensure to never lose focus of our clients’ specific needs through a so-called “caretaker model” whereby one global and one local caretaker is designated for a specific client or project.

Companies from Italy benefit in particular from our strong presence in Italy and Malaysia which allows us to manage cross-border investments and business activities between the two countries by having competent and experienced advisors on both sides.

Learn more about Rödl & Partner Malaysia HERE

Interested to get in touch with a representative of Rödl & Partner Malaysia? Call Rödl & Partner Malaysia at +60 3 2276 2755 or email us at info@italcham.my.